2023 Tax Return Preparation

2023 Tax Return Preparation

We are currently accepting 2023 Tax Return Preparation reservations.

To Upload Your 2023 Tax Information, Follow The Instructions Below:

Once we receive your tax forms and deposit, we will begin your 2023 return. We will update you on your progress as we move through the process.

1. Open the attached Tax-Organizer TY2023 to fill out our fillable organizer/questionnaire. Save and upload using your ShareFile account created below.

2. See below to securely upload your 2023 tax documents. You may not have them all right now. That's ok. You can upload them as soon as they come in. Save and upload using your ShareFile account created below.

3. For New Clients, please scan and upload a copy of your 2022 tax return, both federal and state, if applicable. Along with your driver's license and social security cards. See below to securely upload your 2022 returns, driver’s licenses, and social security cards.

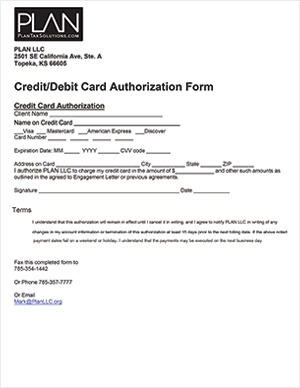

4. Open the attached fillable Debit Authorization Form and fill out to tell us how to pay your $275 deposit that will be required before we start your return. This non-refundable deposit is not your return's total cost. However, it will apply to your total bill. Save and upload using your ShareFile account created below.

5. If you receive additional tax documents later, such as Form K-1, you can upload using the ShareFile account you create below.

- We cannot reserve your spot and begin your return until we have 1, 3 & 4 above.

- Get 2 & 5 info to us as you receive.

- If you have any questions or concerns, email, or call.

Click here to SECURELY upload files above by creating your ShareFile account.

(If do not get a receipt confirmation within 48 business hours call 785‐357‐7777).